Financial Services &

Private Data

Financial institutions manage some of the world’s most sensitive and regulated data—from PII and financial records to investment and credit histories. This data spans legacy systems, cloud platforms, endpoints, and third-party apps, expanding their digital footprint and increasing exposure to risk.

To protect customer trust and meet strict regulations like GLBA, PCI-DSS, SOX, NYDFS Part 500, and GDPR, financial firms must ensure strong data visibility and consistent protection across all environments. Whether handling customer profiles or real-time transactions, safeguarding sensitive data is essential for operational and regulatory success.

“Before Spirion, our data security strategy was reactive and fragmented. Now we can proactively control sensitive data everywhere it exists.”

– Chief Risk Officer, Mid-Market Investment Firm

Challenge

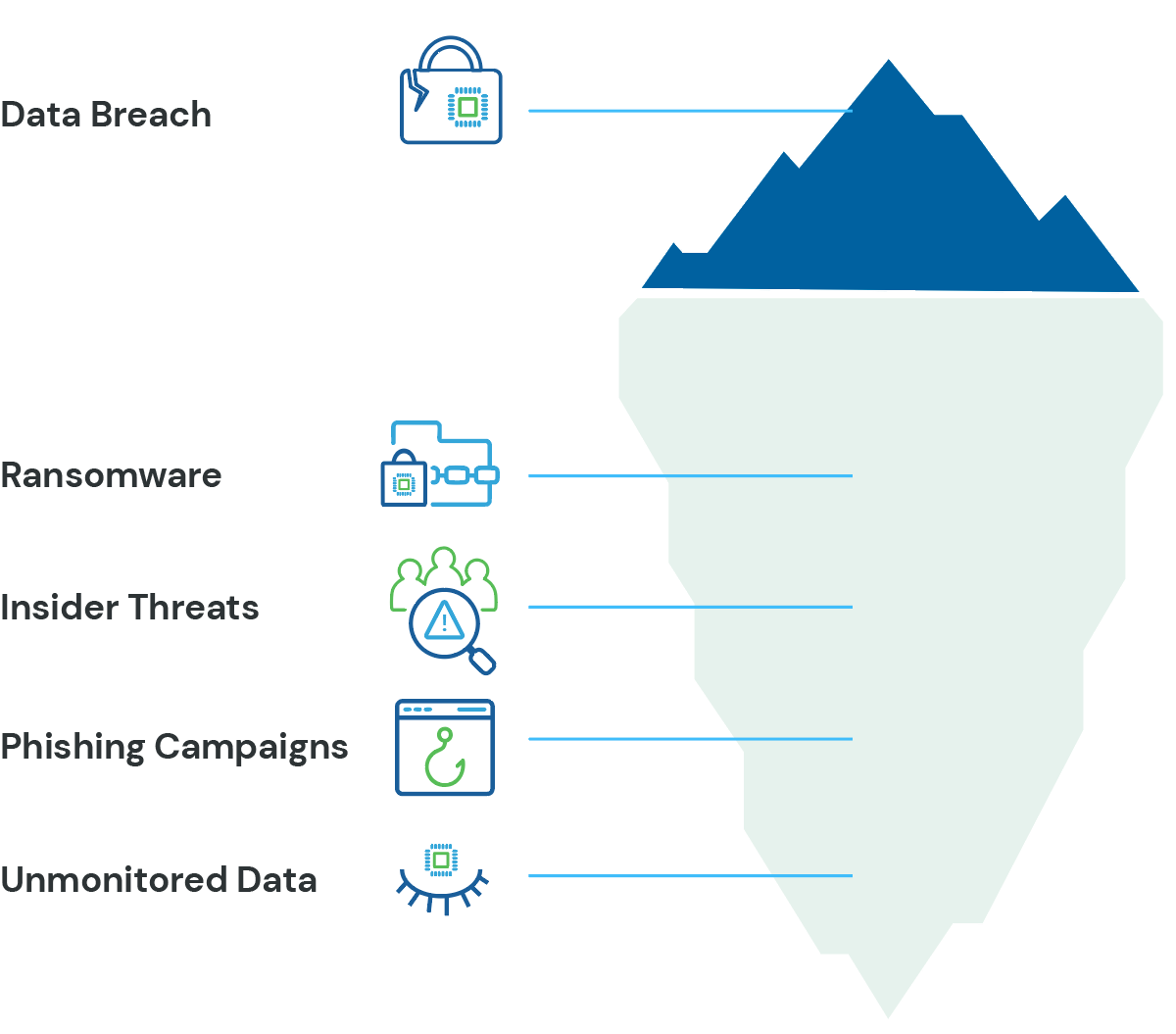

Financial institutions operate in high-risk environments characterized by complex data flows, escalating threats, and stringent regulatory oversight. The combination of sensitive data types, cross-border operations, and third-party integrations makes it difficult to maintain consistent protection without sacrificing efficiency or customer experience.

Sensitive data is often overexposed, improperly stored, or duplicated across systems without clear ownership. Security teams struggle to track where data resides, how it is moved, or who has access to it. Misconfigurations in file sharing, shadow IT, and legacy tech introduce risk, while regulatory bodies expect demonstrable control over data lifecycle management and incident response.

Meanwhile, threat actors target financial firms at a rate several hundred times greater than other industries. Data breaches cost millions in remediation, regulatory fines, and reputational harm. Organizations face mounting pressure to enforce continuous compliance, streamline audits, and mitigate operational risk—all without disrupting business continuity.

Figure 1: Cyberattacks on the financial industry eclipse every other industry.

Solution

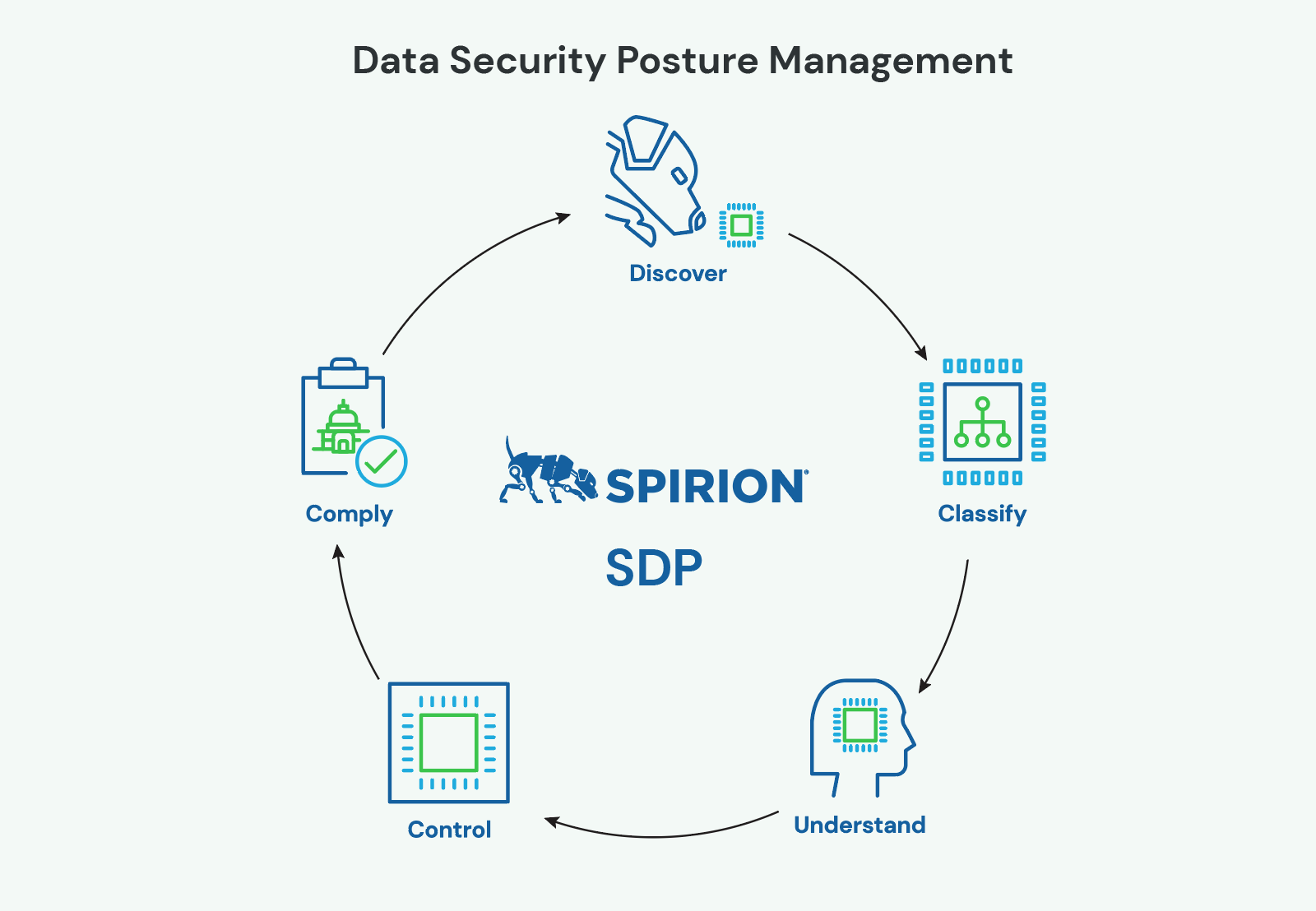

To meet these challenges, financial organizations turn to Spirion Sensitive Data Platform (SDP), a scalable, hybrid-first solution for proactive data discovery, classification, remediation, and compliance. Spirion empowers IT, security, and governance teams with the tools to build a privacy-first culture while improving visibility, control, and protection across all environments.

Discover

Spirion’s proprietary discovery engine uses advanced content-aware scanning and AnyFind™ technology to locate sensitive data across endpoints, cloud repositories, file shares, structured databases, and unstructured files. With 98.5% accuracy, organizations gain a comprehensive map of where regulated data resides, no matter how deeply buried or fragmented it may have become.

Classify

Once discovered, data is automatically and persistently classified based on HIPAA, HITECH, PCI-DSS, and organizational policies. Spirion’s dynamic tagging system ensures every record is accurately labeled, prioritized, and aligned with appropriate privacy actions.

Understand

Dashboards provide insight into the sensitive data landscape, showing where risk lives. Teams can quickly identify vulnerabilities, overexposed files, and compliance gaps.

Control

With Spirion’s remediation playbooks, organizations can automate data protection actions, including redaction, quarantine, and access revocation. These actions are executed consistently across systems, reducing response times and human error.

Comply

Continuous compliance monitoring supports financial industry mandates, including GLBA, PCI-DSS, NYDFS, SOX, and evolving global privacy laws. Spirion produces audit-ready reporting, retention enforcement, and compliance alerting, minimizing manual review and human error.

Spirion’s hybrid-first architecture ensures performance at scale, with discovery agents and orchestration layers deployed across on-premises, cloud, and edge environments. With deep integration into security ecosystems, Spirion delivers context-aware protection wherever sensitive data travels.

Figure 2: DSPM provides visibility as to where sensitive data is, who has access to it, how it has been used, and the security posture of the data store or application.

Results

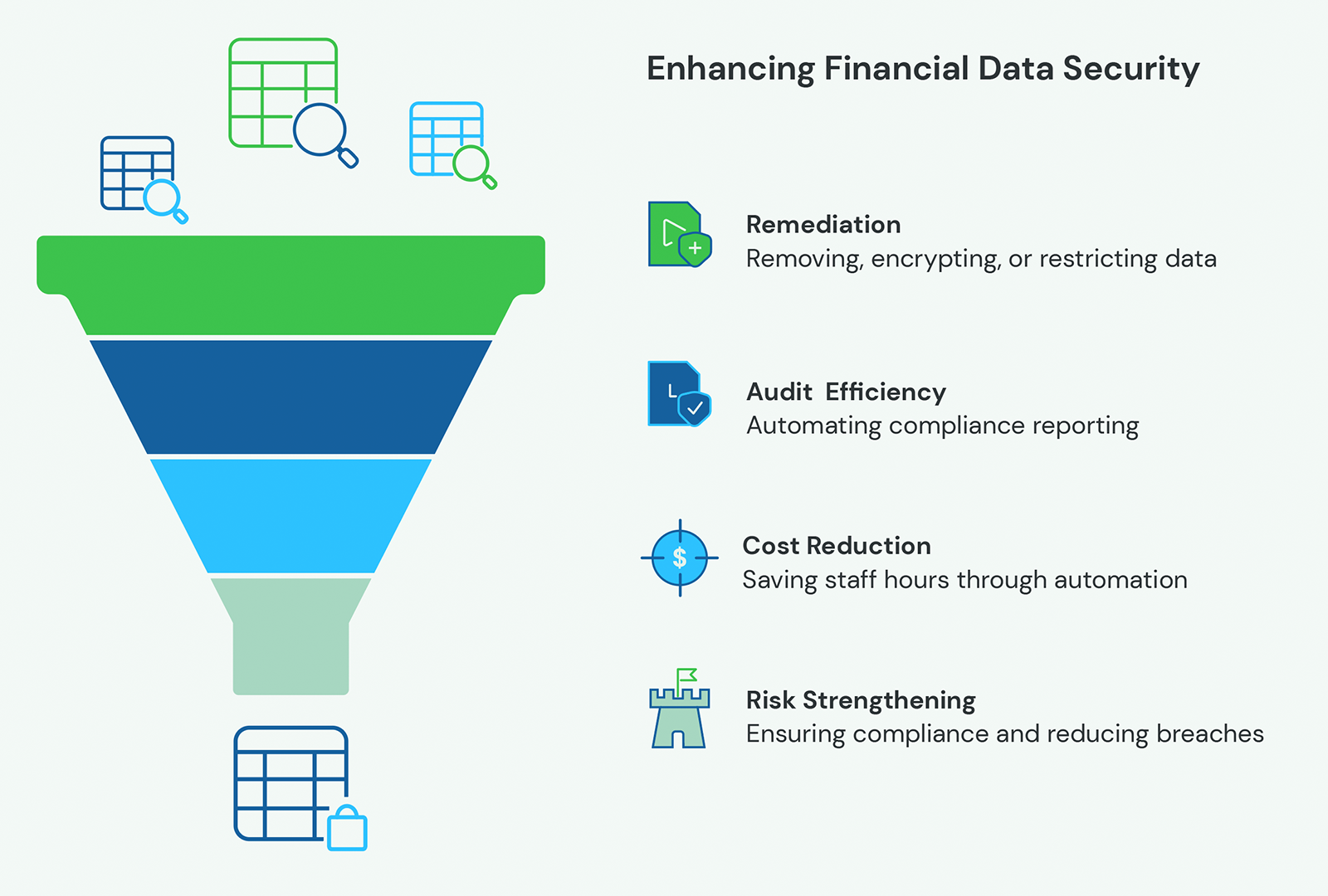

Spirion delivers measurable value to financial organizations by enhancing data confidence, accelerating remediation, and achieving improved compliance outcomes.

- Data Exposure Reduced: Financial services customers can experience up to a 90% reduction in exposed PII after discovery and remediation. Unsecured files on shared drives and endpoints can be either removed, or access-restricted within weeks of implementation.

- Audit Efficiency Improved: Firms accelerate GLBA and PCI-DSS readiness by using Spirion’s automated classification and reporting. What previously took weeks of manual effort now occurs continuously in the background.

- Operational Costs Lowered: IT teams save hundreds of staff hours per year by eliminating manual searches and ad hoc remediation tasks. With automated playbooks and intelligent alerting, data risk workflows became faster and more predictable.

- Risk Posture Strengthened: With full data visibility and enforcement controls, financial industry customers gain assurance that sensitive financial records are handled by regulatory requirements and internal policies, thereby reducing the risk of breach or penalty.

Figure 3: Spirion Sensitive Data Platform provides confidence in financial data protection.

Real-World Scenario: Securing Sensitive Client Records at a Mid-Size Investment Firm

The following account is a fictionalized example based on common financial services scenarios and real Spirion customer outcomes.

A mid-size investment and wealth management firm discovered its internal operations team had been storing sensitive client documents such as portfolio summaries, tax records, and scanned IDs across various departmental file shares and employee laptops. After preparing for a GLBA audit, the firm realized it lacked an inventory of where sensitive data lived and could not confirm who had access to what.

With Spirion, the firm launched a comprehensive discovery scan across over 800 endpoints, cloud repositories, and SharePoint instances. Within days, the platform identified 11,000 files containing unencrypted PII and financial data, including Social Security numbers, routing details, and signed forms.

Classification policies were applied instantly, labeling content according to sensitivity and retention rules. Automated remediation policies were deployed to redact sensitive data from necessary files, where appropriate, and quarantine legacy records, followed by shredding them after a cooling off period.

As a result, the firm achieved an 35% reduction in exposed financial records within three weeks. The GLBA audit concluded with zero compliance findings. Internal governance teams gained confidence in their ability to enforce policy across systems, and data access request response times were reduced by half, thereby improving client trust and internal efficiency.

Looking Ahead

As financial services firms grow more digital, mobile, and connected, data protection must evolve from reactive firefighting to proactive risk management. Sensitive data must be continuously discovered, governed, and protected—wherever it exists.

With Spirion, financial organizations gain the clarity and control needed to navigate this complexity. They reduce data exposure, streamline audits, enhance compliance, and mitigate risk, without compromising agility or client service.